Fee

A breakdown of current Jungle Exchange fees incurred for each function.

Trading Fee Tier

According to market conditions, especially volatility, Jungle Exchange sets different trading fee rates () for traders (takers) and LPs (makers) under different markets and corresponding trading activities. There are 4 tiers involved - Open Maker, Close Maker, Open Taker, Close Taker.

Opening Position as Market Maker (Open Maker)

Opening Position as Taker (Open Taker)

Closing Position as Market Maker (Close Maker)

Closing Position as Taker (Close Taker)

Note that :

You will be directed to third-party platforms for bridging, swapping, and buying. Jungle will not charge extra fees.

There are no fees charged by Jungle Exchange for Minting or Burning. Only a small amount of gas fee is paid outside of the platform to miners for validating your transactions on L2 blockchains.

Service Fee Tier

While adding liquidity does not incur an extra fee, to maintain healthy market dynamics and our platform’s sustainable growth, LPs will be charged a service fee upon the removal of liquidity. Jungle Exchange sets different Advance Service Fee Rate () and Base Service Fee Rate () based on profits and position size under different markets and corresponding trading activities. During the early phases of the Mainnet launch, we will also offer discounts on fees.

Adding Liquidity: No fee taken.

Removing Liquidity:

where:

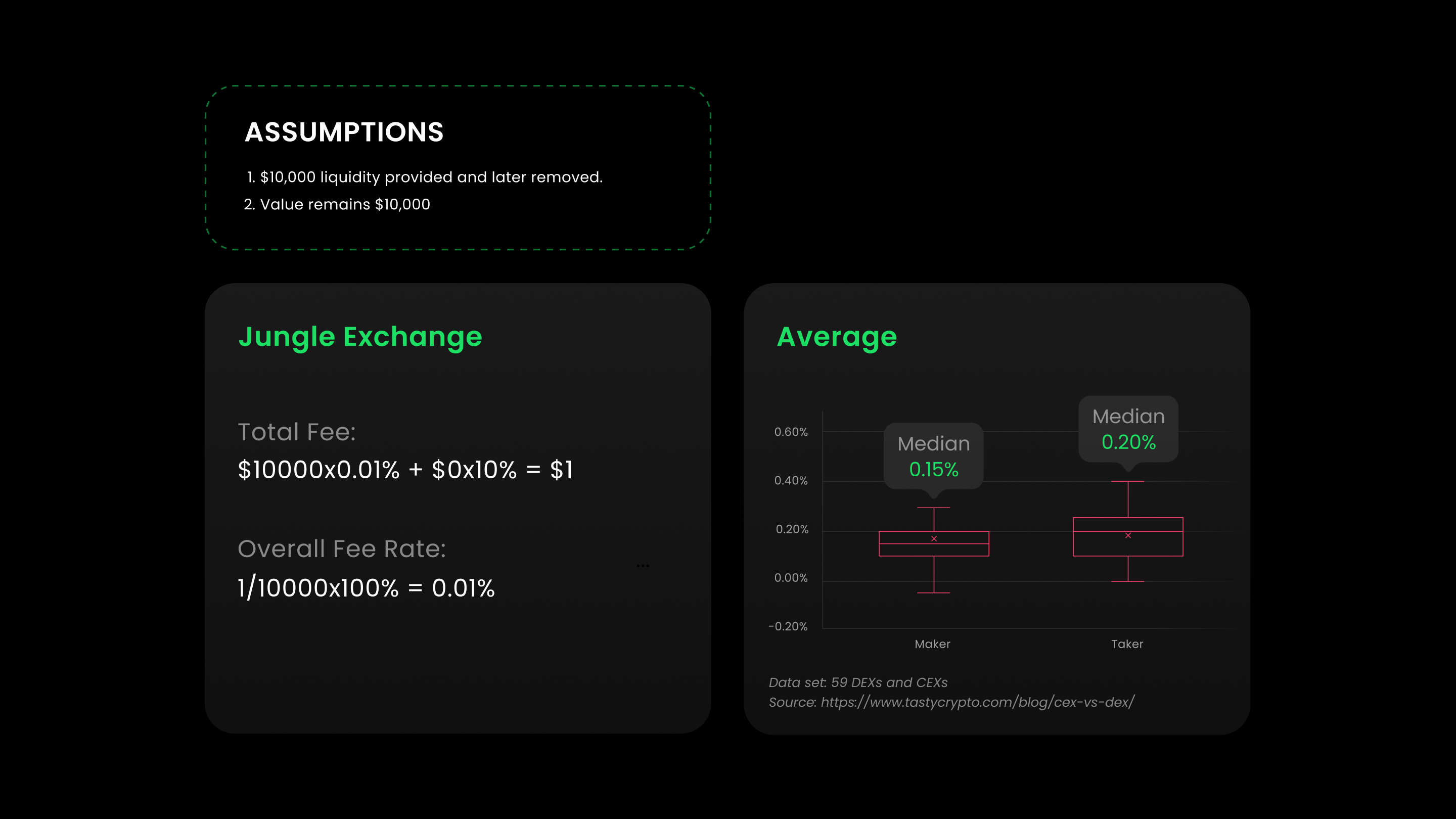

For Example: Assuming a market maker removes a 10,000 USDC amount of liquidity, with the initial balance of which being 10,000 USDC, and returns being 0 USDC, then the service fee charged will be 1 USDC, with the overall fee rate being as low as 1 bps.

Jungle Exchange simplifies fees for LPs with only Service Fee and Trading Fee, the latter being fully reimbursed to the Pool. This results in significantly lower costs for LPs.

Variable Fees

Jungle Exchange V2 is introducing new governance functionality, empowering liquidity providers (LPs) to determine the trading fee income they wish to accrue for their pool. Aligning with their pool strategy, market makers are granted the flexibility to select an optimal trading fee rate within a specified range.

The existing fee arrangement will persist until the activation of the governance feature, subject to approval through a voting process. Once activated, LPs gain the ability to propose alterations to the fee structure via the governance mechanism.