Order Types

Perpetual trading refers to a type of trading contract commonly found in cryptocurrency markets. Perpetual contracts are derivatives that don't have an expiry date, unlike traditional futures contracts. They allow traders to speculate on the price movements of assets (like cryptocurrencies, indices, commodities) without a predetermined expiration.

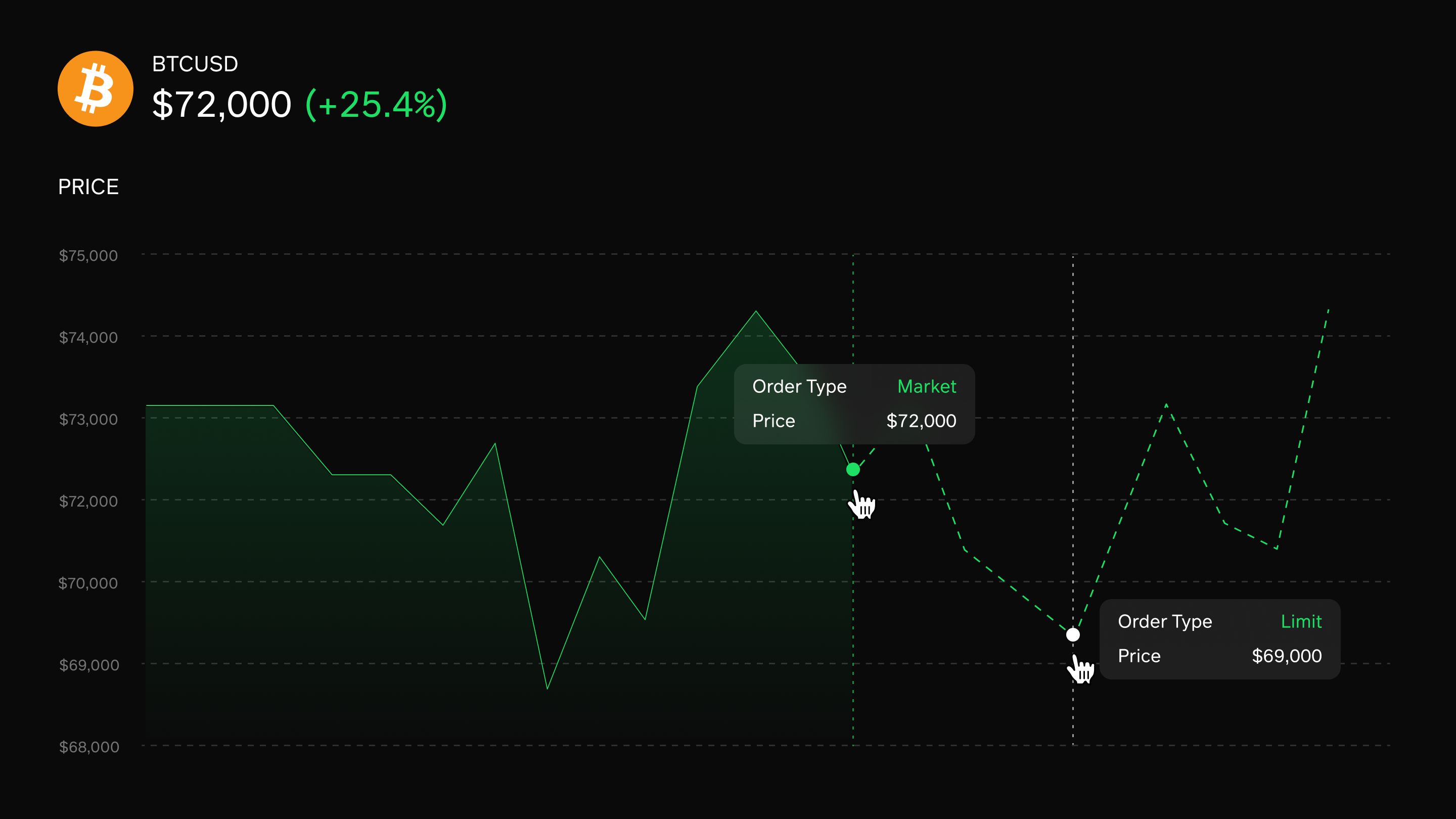

Currently Jungle Exchange supports 2 order types:

- Market Order : immediate order execution at current market price.

- Limit Order : an order that executes at limit price or better.

Market Order

A market order is a specific type of order that traders buy or sell an asset on Jungle Exchange at the current market price. Unlike a limit order, which specifies a particular price, a market order is executed as quickly as possible at the best available price provided by Order Matching Router.

Buy/Sell Limit Order :

-

A buy/sell limit order is used when a trader wants to buy a specific asset.

-

The trader can place a buy/sell limit order with a limit price below (above for sell) the current market price.

-

This means that the order will only be executed if the market price drops (rises for sell) to the specified limit price or below (above for sell).

-

By using a buy/sell limit order, the trader can potentially purchase/sell the asset at a lower/higher price.

-

Due to the constantly changing market conditions and the strategy settings of the Market Maker Pools, the price of a matching order may vary significantly before successful execution. Under some circumstances, the order would fail. This often occurs when the buy/sell ratio is close to or equal to 100%.

-

A limit order works better for those who can wait with a specific price target, for traders in volatile markets to maximize profits or minimize losses, and for large-scale orders to avoid potentially unfavorable market conditions.

Limit Order

A limit order is a specific type of order that traders can place on Jungle Exchange with a predetermined limit price. This allows traders to specify the maximum price at which they are willing to buy or the minimum price at which they are willing to sell a particular asset. The execution of a limit order is dependent on the market price reaching or surpassing the specified limit price. By setting a limit price, traders can ensure that they only execute trades when the market conditions align with their desired price levels.

Buy/Sell Limit Order :

-

A buy/sell limit order is used when a trader wants to buy a specific asset.

-

The trader can place a buy/sell limit order with a limit price below (above for sell) the current market price.

-

This means that the order will only be executed if the market price drops (rises for sell) to the specified limit price or below (above for sell).

-

By using a buy/sell limit order, the trader can potentially purchase/sell the asset at a lower/higher price.

-

Due to the constantly changing market conditions and the strategy settings of the Market Maker Pools, the price of a matching order may vary significantly before successful execution. Under some circumstances, the order would fail. This often occurs when the buy/sell ratio is close to or equal to 100%.

-

A limit order works better for those who can wait with a specific price target, for traders in volatile markets to maximize profits or minimize losses, and for large-scale orders to avoid potentially unfavorable market conditions.