Position Management

Open Position

Currently Jungle Exchange supports 2 types of orders:

-

Market Order: immediate order execution at current market price.

-

Limit Order: an order that executes at limit price or better.

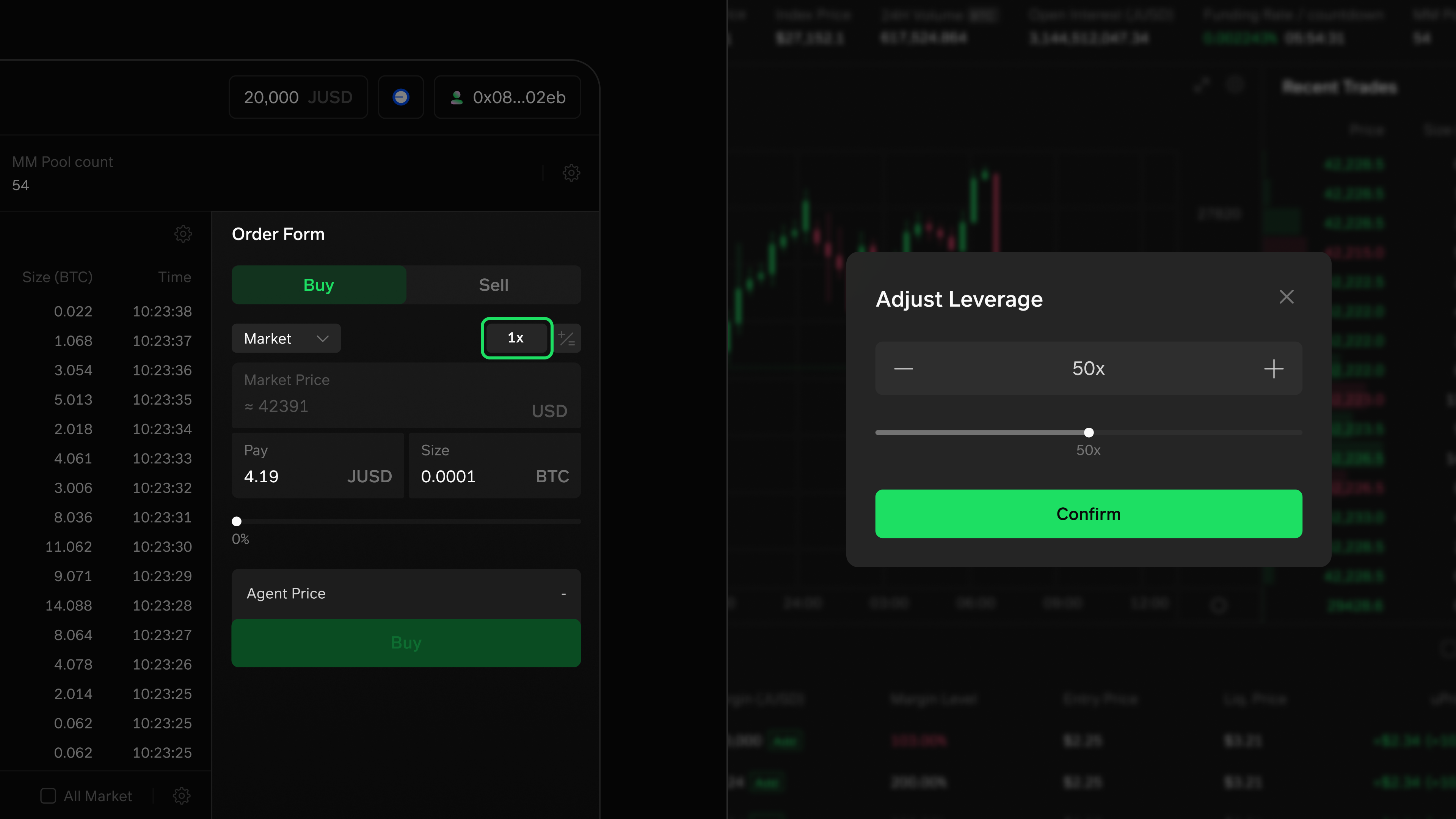

Specify order type, direction, position size, slippage and leverage to open a position.

Leverage can be adjusted by sliding, clicking + - buttons, or directly entering specific number.

Input the position size, or slide to the percentage of USDC you would like to add as margin from your balance, and the position size will be displayed.

Note: When entering size, it must be a multiple of the contract size. This is because Jungle Perpetuals are based on U-Margined Contracts, priced in the underlying asset‘s contract size, settled and margined in stablecoin USDC. For example, in the market price of Jungle U-Margined Contract 'BTCUSD' with a contract size of 0.1, you can enter 0.2 BTC, but not 0.21 BTC.

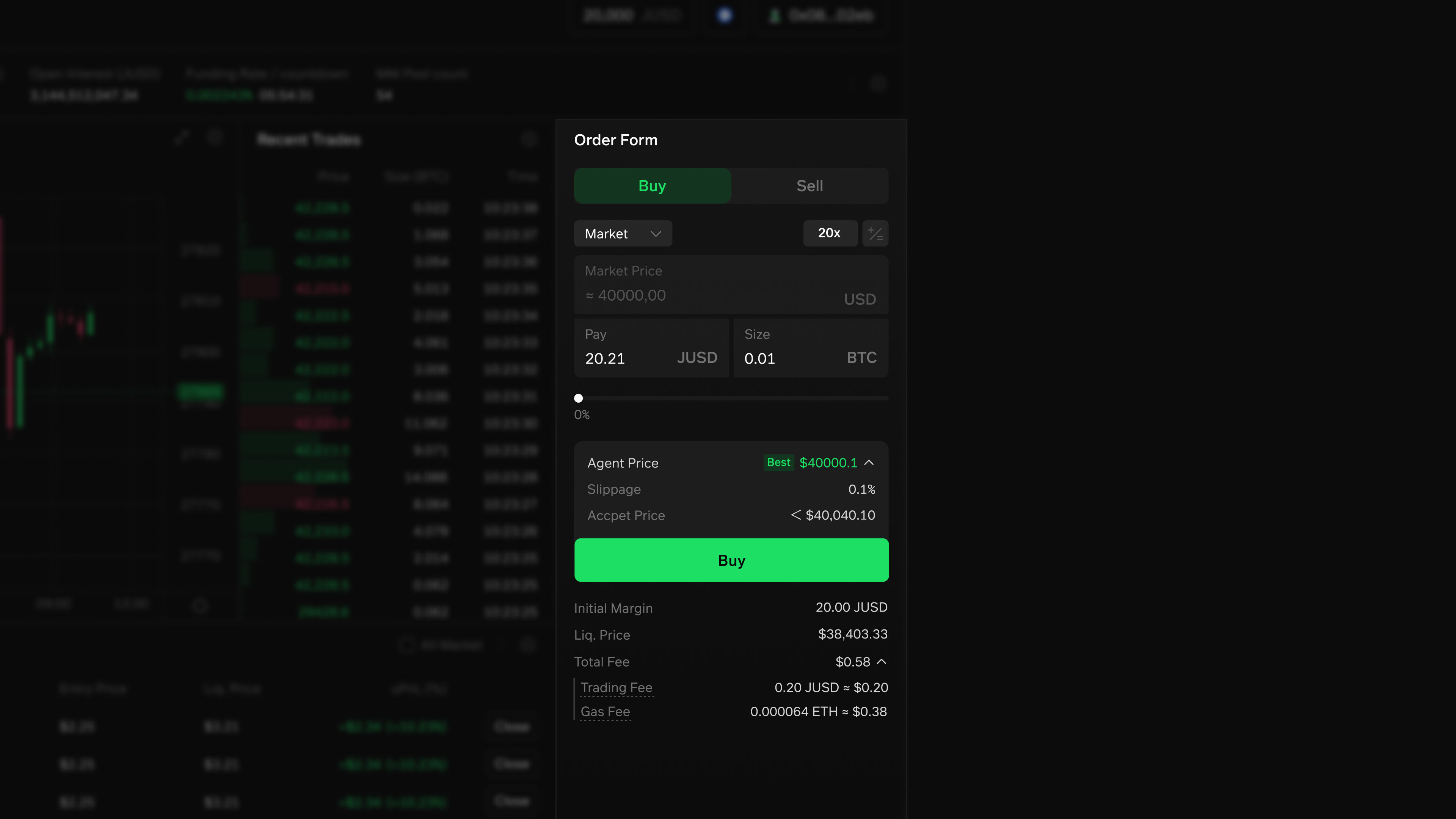

Price Quote

Review the quote and estimated position information.

-

the arrow beside Quote Priceshows the price information. After the order matching process via the Order Matching Router, the best price will always be presented due to its mechanism. -

Slippage: set to 0.1% for now.

-

Accept Price: Calculated through Quote Price, Order direction and Slippage.

-

Initial Margin: USDC added.

-

Liq. Price : The price at which liquidation will be triggered once met, calculated via: For long and short positions:

where we have margin , position size , entry price , liquidation price , set constant fee rate , and set constant maintenance margin rate .

-

the arrow beside total feeshows the costs consisting of trading fee (to platform) and gas fee (to network).Open Position: Click to submit transaction once you have reviewed all details carefully. Upon submission, approve token spending and sign for trading execution. The order will be matched and executed automatically at the best price available.

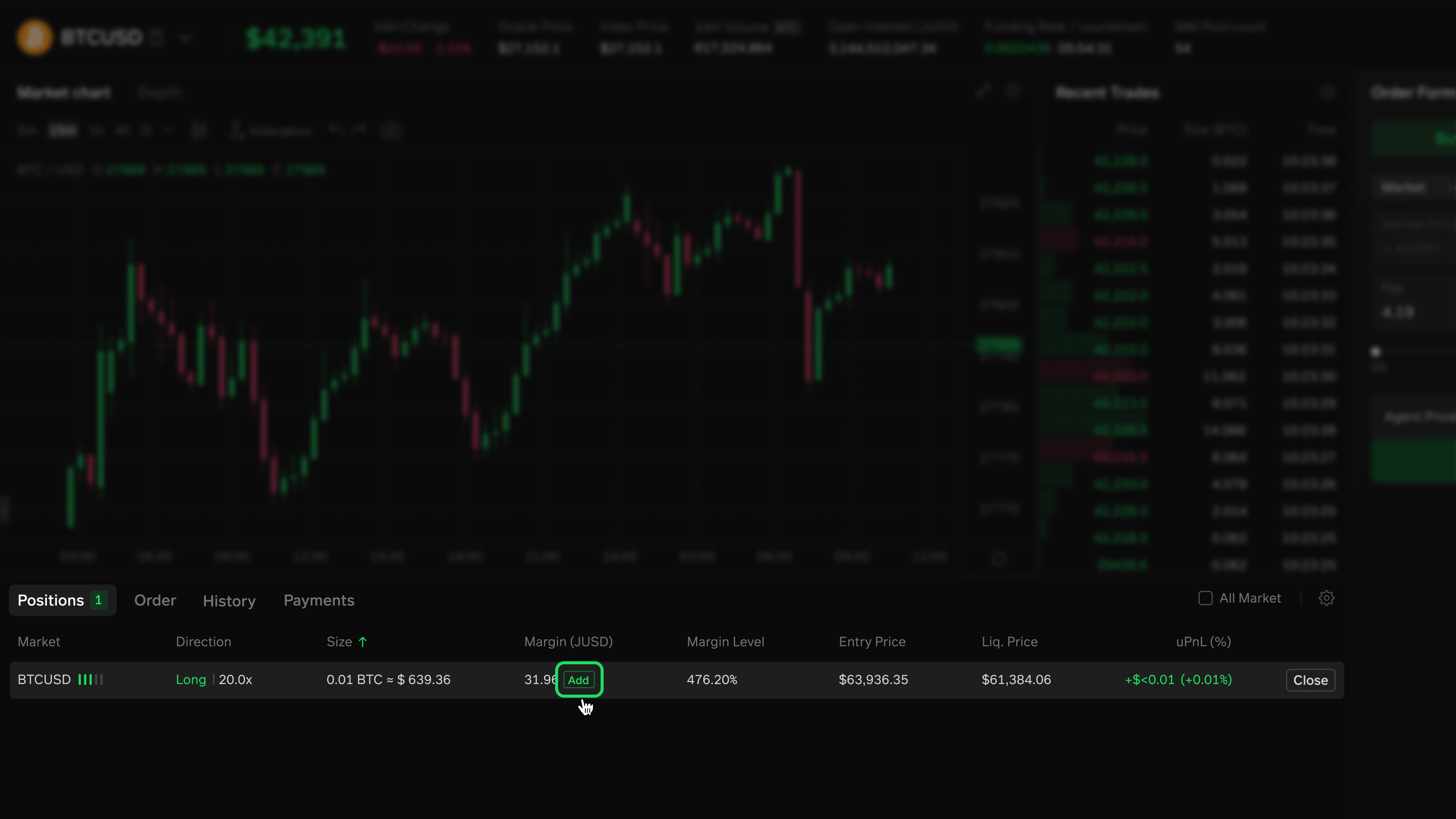

Margin Adjustment

When you navigate to the "Position" tab, you can easily adjust your position's margin by adding or reducing USDC.

Click on the margin adjustment icon to open the "Adjust Margin" popup

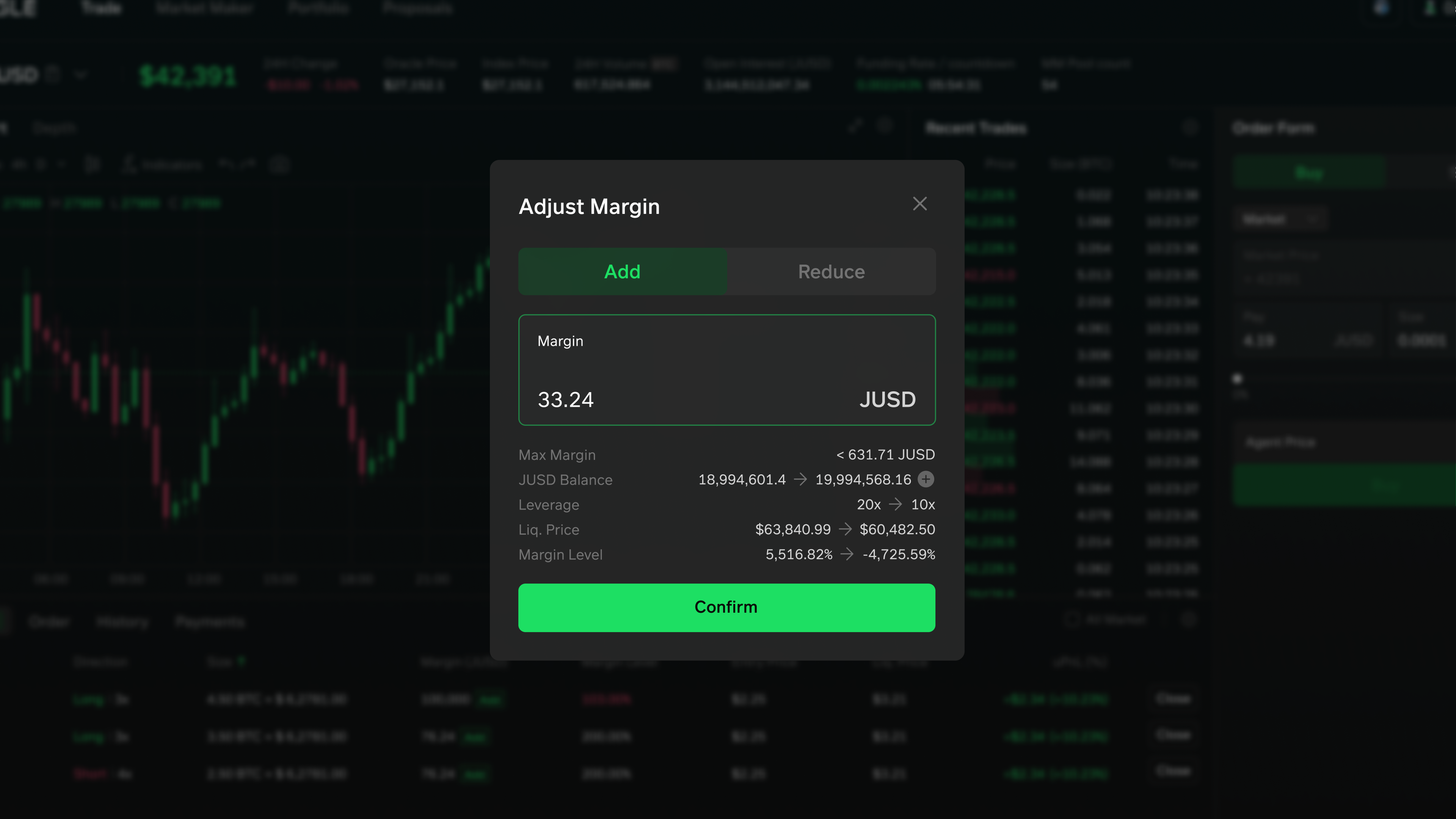

By default, the "Add" tab is selected.

To add margin, input the desired margin amount in USDC.

-

Max Margin: the upper limit of margin added is the amount which makes leverage turn to 1x.

-

USDC Balance: Your balance after deducting the amount added to margin. Click to be redirected to the minting page. -

Leverage: the new leverage considering the margins added

-

Liq. Price: price at which liquidation will be triggered

-

Margin Level: how close your position is to liquidation

Click Confirm to add margin.

To remove margin, input the desired margin amount in USDC.

-

Reduce Limit: the upper limit of margin reduced is the amount which makes margin level turn to 100%, triggering liquidation.

-

Leverage: the new leverage considering the margins removed

-

Liq. Price: price at which liquidation will be triggered.

-

Margin Level : how close your position is to liquidation.

Click Confirm to reduce margin.

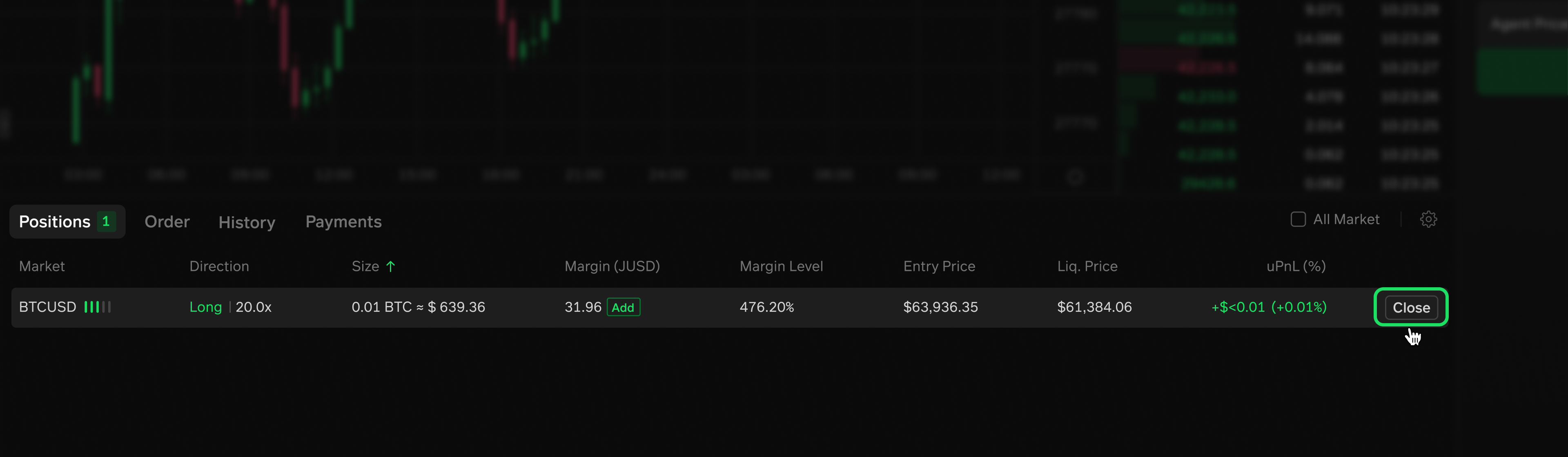

Close Position

Close Position from the Close button in the Positions Tab.

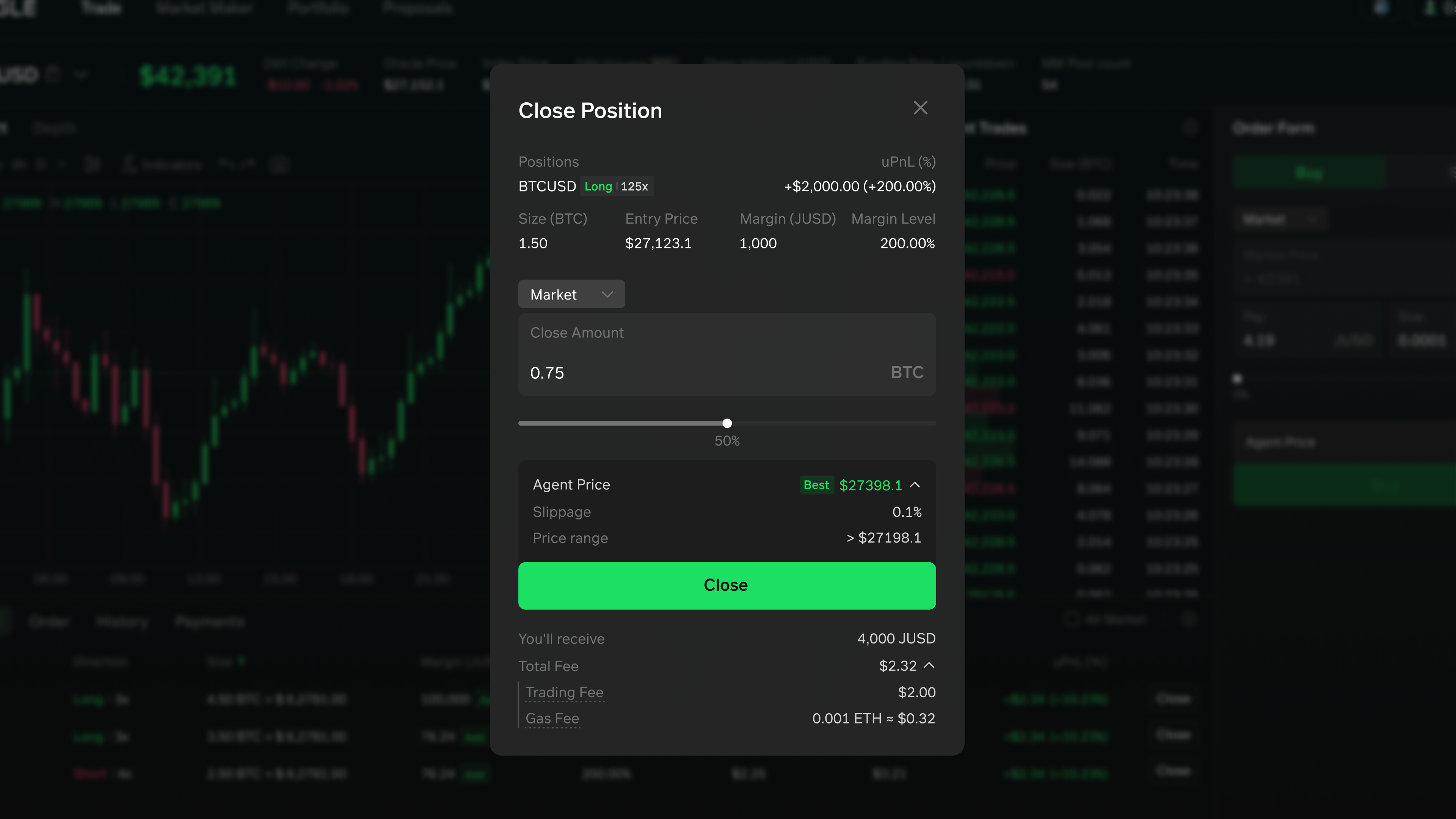

Specify the underlying asset’s closing quantity in the input field of the pop up window. Close position details will be shown:

-

Positions: Market, Position Direction, Leverage

-

uPnL : Unrealized Profit and Loss

, positive for long, negative for short.

-

uPnL% : Unrealized Profit and Loss Rate compared to Margin.

-

Size: Current position size.

-

Entry Price : The price at which the position was opened

-

Margin

-

Margin Level : Regardless of Position size, liquidation will be triggered when Margin Level = 100%, that is, considering the trading fee of closing your position, your current account amount, compared to your current position value, has reached our maintenance margin rate MMR.

- Margin level below 125% will show in red as a warning.

-

Order Type: Click to choose the close position order type between market and limit. -

Close amount: Enter the specific close amount in the bar, or use the slider below. Either way, amount entered must be an integer multiple of contract size. -

Quote Price : Best price quoted by order-matching engine. Click

arrowbeside it to show/hide price details: slippage and accept price. -

USDC to be received

-

Total Fee: Total transaction fee including trading fee charged by platform, and gas fee charged by network. Click

arrowbeside it to show/hide fee payment details

Click Close Position and approve in your wallet for transaction submission. Upon successful transaction, you can view your details in the trading metrics table.